As speculation builds that a cut to Australia’s cash rate could be arriving in the near future, several of Australia’s lenders have been adjusting their home loan interest rates over the past week.

Beyond Bank has slashed fixed rates across a range of mortgage products, including its Total Home Loan Packages and Pinnacle Plus Packages.

Fixed rates were slashed as low as 3.79% p.a. (comparison rate 4.88% p.a.) for Beyond Bank’s Total Home Loan Package 3-year special, though the most substantial cuts were for its Total Home Loan Package investment loans, which fell 20 basis points to as low as 4.19% p.a. for selected loans (comparison rates: 5.34% p.a. for 1-year fixed, 5.26% for 2-year fixed, and a 5.19% p.a. for 3-year fixed).

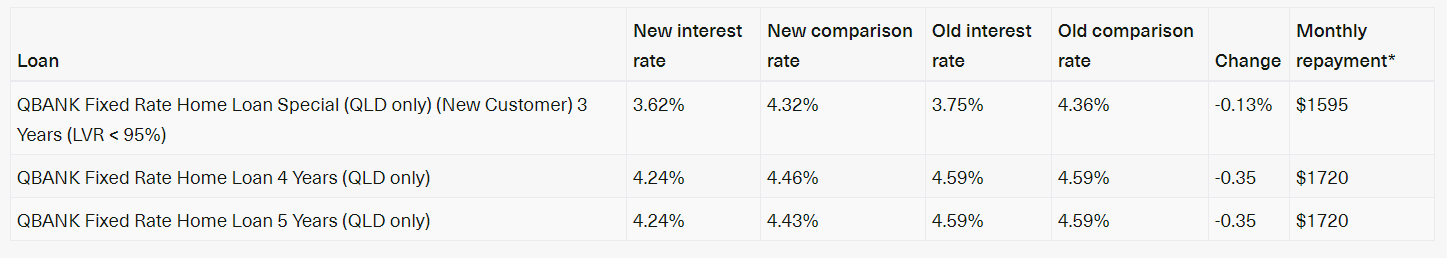

QBANK also cut fixed rates on a selection of its home loans for owner occupiers and investors, going as low as 3.62% p.a. (comparison rate 4.32% p.a.) for its 3-year Fixed Rate Home Loan Special after a fall of 13 basis points.

The deepest rate cuts from QBANK were for its 4 and 5 year Fixed Rate Home Loans, whose fixed rates fell by 35 basis points to 4.24% (comparison rate 4.46% for 4 year fixed, and 4.43% for 5-year fixed).

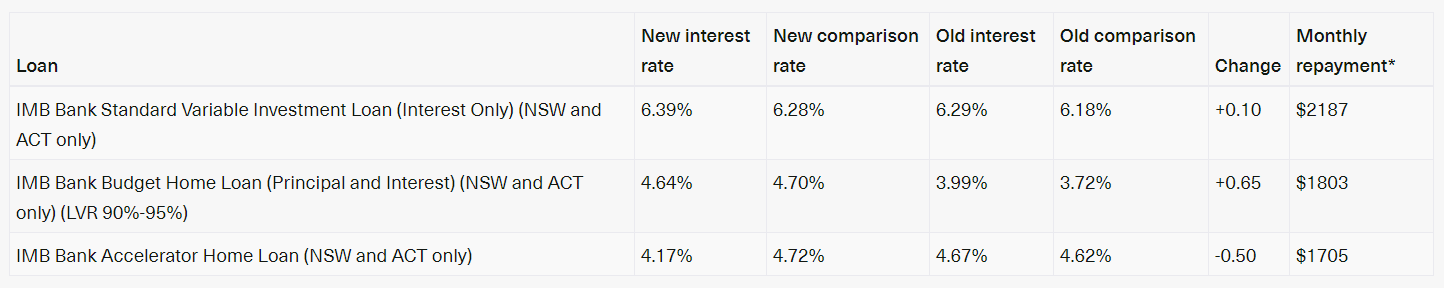

But not all lenders have been cutting rates – IMB Bank has recently raised variable interest rates on selected principal & interest and interest-only mortgage offers.

Selected interest only loans from IMB Bank saw their variable interest rates increase by 10 basis points across the board, going as high as 6.39% (comparison rate 6.28%) for an interest-only Standard Variable Investment Loan.

Selected IMB principal & interest home loans also experienced rate rises, going up by as much as 65 basis points for the 90%-95% LVR Budget Home Loan, bringing its variable rate to 4.64% (comparison rate 4.70%).

At the same time, IMB Bank cut the interest rate on its Accelerator Home Loan by 50 basis points to 4.17% p.a. (comparison rate 4.72% p.a.).

If the Reserve Bank of Australia (RBA) decides to cut the nation’s official cash rate at its next meeting in June 2019, certain lenders could end up dropping their mortgage rates to 3.20% or even lower.

Source: www.ratecity.com.au